Message from our CEO

We’ve seen many positive changes in the last year, including continued growth and innovation among our existing customers, the addition of new customers to the OneShield family, and significant investments in our software solutions and delivery capabilities. Everything we do at OneShield is driven by our mission of empowering our insurance customers to achieve their business objectives, both today and in the future.

A key area of our business’ evolution that I’d like to highlight is our talent. One of our company-wide objectives is to be the industry’s #1 place to build a career. Success in this regard impacts every other part of our business, allowing us to tackle more aggressive items on our technology roadmap, and to be more value-added partners to our customers. I am pleased to report that we are progressing tremendously on this front. Here are just a few highlights:

Team Size: We have expanded our team to approximately 440 people (up from 250 just two and a half years ago), including full-time partner resources. We expect to add another 60-80 people (net) to the OneShield team in 2023. Last fall, we created a new SVP of Talent role and hired a gentleman (Paul Thatcher) with experience scaling global tech companies to 800+ people, which is the direction we are headed.

Productivity: We are significantly expanding our portfolio of onboarding, training, and enablement tools and resources (both for our people, partners, and customers). As just one example, we recently struck a deal with The Institutes to provide the entire OneShield team with “all-you-can-eat” access to their AINS and CPCU training content. In just a few months, nearly 100 of our people – mostly our technical resources – are midway through earning their AINS certification (in addition to the CPCU and AINS holders already at OneShield).

Retention: Investments in our people are already paying off. Our employee NPS and retention have increased meaningfully two years in a row, and our Glassdoor ratings are now among the best in our industry. We have also seen a 10-point increase in LTM employee retention, which is now at 87% (which is high for our industry, especially given our India footprint). This allows us to rapidly build our cumulative in-house OneShield experience, which is now approaching 1,500 years.

All of this progress directly benefits our customers and will continue to do so in the coming years. Of course, many other exciting developments and investments are happening across OneShield, and we look forward to sharing those with you in the coming months across various forums.

You may notice that we recently updated our company image and messaging. Inspired by input from many clients, our team, and industry influencers, our new brand reflects our company values and the experience we are building for you – one with limitless potential. Check out our teaser video if you haven’t seen our new look.

Finally, sincere thanks from all of us at OneShield for your continued partnership. We look forward bullishly to another year of supporting your growth and success and helping you move beyond to a brighter future.

.png?width=300&height=298&name=Group%2023%20(1).png)

Cameron Parker

CEO, OneShield

Growing our team with industry leaders

With over 25+ concurrent projects, including core upgrades, new development, BAU, maintenance workstreams, and support, we have added over 180 people to the OneShield family. This brings our company headcount to our highest ever, with over 440 people - including full-time partner resources!

Our recruiting efforts have focused on targeting the best talent in the industry with deep experience – let us introduce you to six recent new hires:

Charlene Raterman

Program Director

Charlene joins OneShield’s Customer Success Team as a Program Director supporting our OneShield Enterprise clients in their transformational journey. Charlene brings nearly 25 years of experience leading IT delivery projects in the Insurance, Financial Services, and Retail industries. At Nationwide Insurance, she held many positions, including Program Management and Agile Delivery. She created Agile Methodologies and served as a “Trusted Advisor,” providing risk assessments and recommendations for Nationwide's top Tier programs. Before joining OneShield, Charlene was at Majesco. She was called in to separate product and program management and successfully delivered a unified suite of insurance products for a Fortune 50 client.

What inspires Charlene outside of her work life?

Charlene, a Cincinnati resident, loves running and spends the summer months with her husband and their two boys boating and experiencing the beauty of Lake Erie!

John Paul Byrne (JP)

Program Director

We are excited to have JP join the OneShield Customer Success Team as a Program Director! He comes to OneShield from Nationwide Insurance, where he spent 23 years in technology project and program delivery roles across a diverse spectrum of initiatives in P&C, financial services, and infrastructure.

How does JP create a work-life balance?

Outside of work, JP loves to travel, practice yoga, run, and cultivate other hobbies, too numerous to mention. Born and raised in Sydney, Australia - JP is a long-time resident of Columbus, Ohio.

Joseph Marren

Claims Architect

Joseph Marren joined OneShield at the start of the year as a Claims Architect on the Customer Success team. Joseph has over 12 years of experience working on Claims implementations for Insurance/Reinsurance clients across the US. At Guidewire Software, he worked as a developer on deployments of ClaimCenter. Before that, he managed and developed the ClaimCenter system at Sompo International for over eight years. Before joining OneShield, he worked at Capgemini on ClaimCenter engineering projects and evaluated Life Insurance Claims products.

What inspires Joseph and keeps him busy when he’s not architecting claims solutions?

Joseph lives with his wife in Brick, New Jersey, and has four grown children. To stretch his limits, he is learning to play the guitar and enjoys exploring the great outdoors!

Colin Goredema

Senior Integration Architect

In early December, Collin Goredema became part of the OneShield family as a Senior Integration Architect, joining the Client Services team. He brings over 15 years of experience covering quite a significant portion of our technology stack. He’s worked at leading companies like Levi Strauss, IBM, and AppDynamics, is a Guidewire Certified Integration Specialist, and spent the earlier part of his career at Standard Insurance Company.

While he calls Oregon home, Collin has an exuberant love of travel and sport!

Collin has traveled to all US states for work - except Alaska (we all need a bucket list!). He’s an avid cricket fan and die-hard soccer fan (EPL) – even waking up at 4:30 am to watch games!

Travis Mayfield

Product Manager

Travis Mayfield joined OneShield late last fall as a Product Manager for OMS Reporting and will lead the design and execution of OMS reports. Travis joins us from GEICO, where he played various key roles over the past 13 years. He brings deep experience in carrier operations, reporting and analytics, and program and project management. He also has direct experience in the carrier Business Analyst role working previously with one of our largest competitors!

What fills Travis’ time outside of OneShield (hint: he’s a jack of all trades)?

Travis lives in Fredericksburg, Virginia, with his wife and three children. He loves carpentry (Farmhouse style is his build of choice), having started the hobby a few years back. He's also a huge Washington, DC, sports fan and loves traveling. Travis and his wife traveled to Italy, Puerto Rico, and the Dominican Republic in the past year!

Casaundra Davis

Business Analyst

Casaundra Davis joined us late last fall as a Business Analyst on the OMS Programs team. Before OneShield, Casaundra spent four years in GEICO's Management Development Program, rotating through several leadership roles in claims operations. Her most recent role with GEICO was as a Sr. Business Analyst for their claims application.

Some fun facts about Casaundra:

Casaundra is a Buckeye (Hint: She graduated from THE Ohio State University!) and lives in Indianapolis with her husband.

Product Updates

We are pleased to announce the launch of OneShield Enterprise v7.0!

Key features are:

Platform

We’ve introduced microservices architecture for greater flexibility and scalability in v7.0. Testing has shown a 30-50% Oracle CPU reduction over v6.0. Those preparing to adopt v7.0 can look forward to reduced processing from the database tier and hardware/license cost benefits, even while experiencing additional growth. Side note, V7.0 is also cloud-optimized and cloud agnostic!

CI/CD Availability

To facilitate your ability to access the benefits of these and future innovations, we are pleased to announce our CI/CD upgrade program. With CI/CD, customers will experience a faster and safer release of new functionality as we provide a regular cadence of incremental upgrades for greater efficiency.

OS Designer

OneShield Designer 7 has just been released! Based on Angular, with an associated 'IDE' for Designer Developers, we are excited to introduce highly improved tools to our developer community.

UI Improvements

We launched an exciting new UI in 2022, bringing a modern and consistent style across the platform. We prioritized efficient click actions, more standardized searches, new layover views for quick reference items, and improved workflows in this upgrade. Ask for a demo!

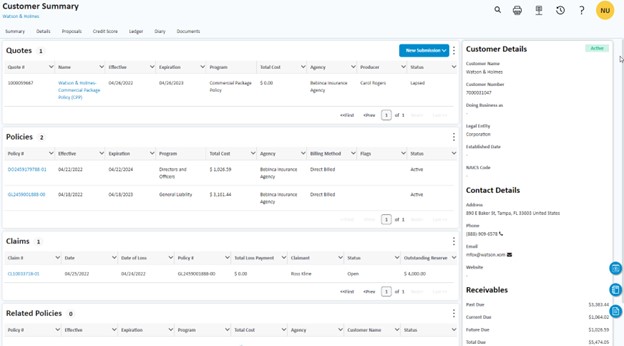

Customer 360

Customer-centric view of the insured accounts includes quotes, policies, claims, related policies by entity, and aggregate policy receivables.

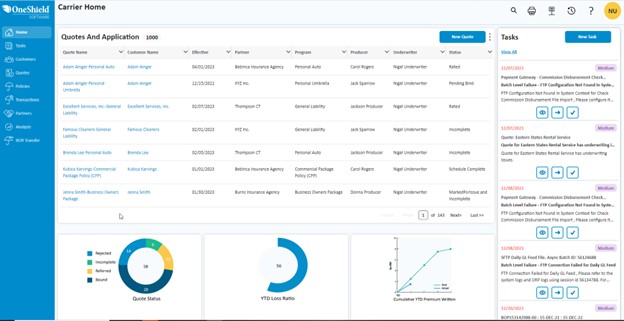

Carrier Workbench

Main navigation pane on the left-hand rail, most recent quotes and an action button, and interactive task management on the right-hand rail (view task, access file, complete task).

Analysis

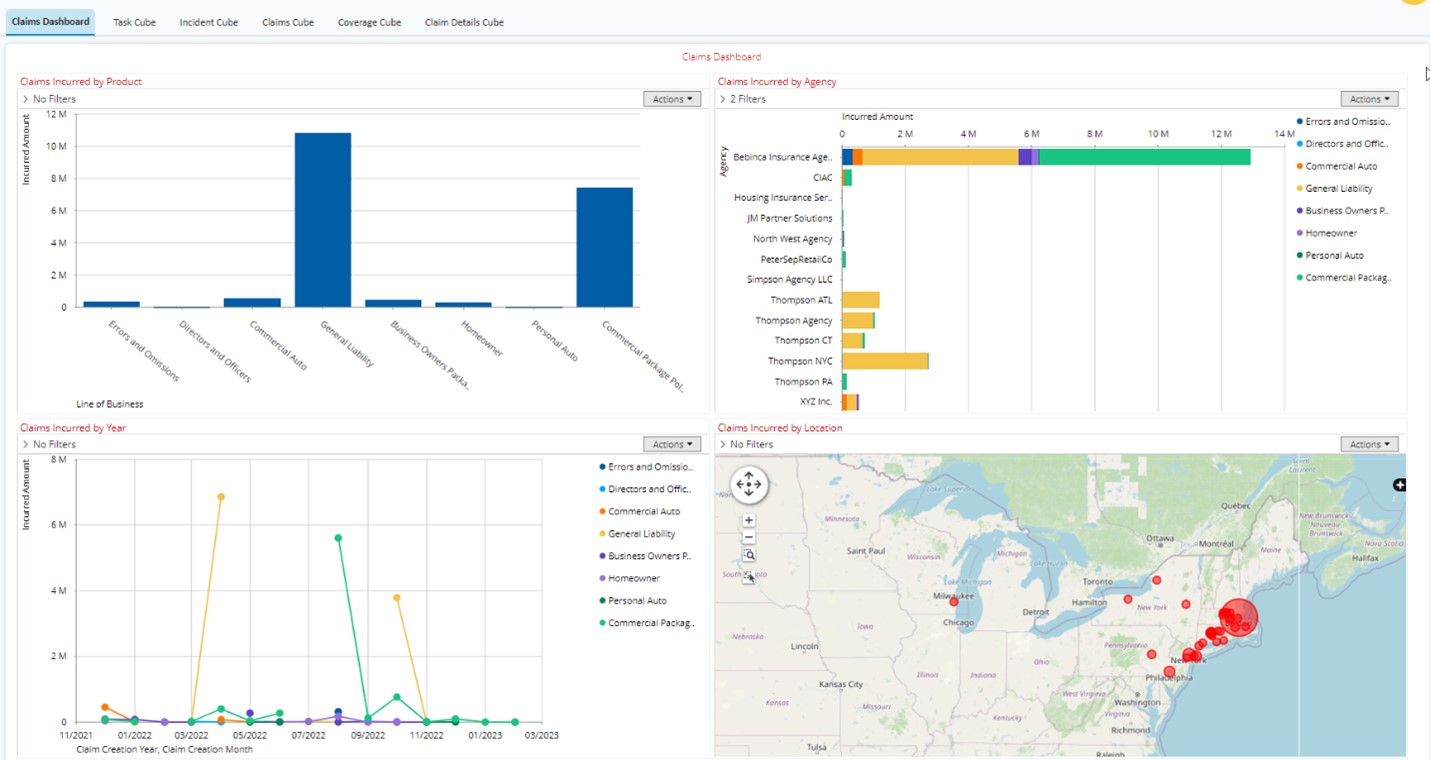

The claims reporting dashboard visually represents incurred claims by product, agency, year, and location with interactive and hover-over details.

Partnerships & Integrations

Partnerships with Airkit and Global Payments Integrated bring new opportunities for policyholder engagement and experience. And our newly formed partnerships with Betterview and Verisk offer additional efficiencies and insights into your underwriting workflows and predictive capabilities. See below for more information on our new partnerships.

Airkit

Airkit’s templated insurance solutions give your team the capability to implement applications that unify customer data into a seamless journey across web, messaging, chat, email, and voice channels—elevating to live agents when needed. Your internal teams can build simple to complex omnichannel applications up to 20 times faster with building blocks purpose‑built for customer experience.

Betterview

Equip your underwriters with accurate, current, and historic parcel information, natural disaster and weather hazard data, and modeling tools to quickly assess the future risk of each property submitted to underwriting. Whether seeking greater accuracy, automation, or a specific risk profile, these tools become critical support to your underwriters.

Verisk

Improving the time to quote is critical to your distribution network and policyholders. Digital access in real-time to current ISO loss costs, rules, and forms exemplify the benefit that API integrations bring to accelerating the underwriting process. Rating policies in real-time, with confidence, that the most recent ISO modifications have been applied, speed to market response time – and save valuable time and resources previously dedicated to interpreting and implementing circular changes on the backside.

Global Payments Integrated

We are building out our payment service within the OneShield platform, with Global Payments Integrated as one of our key vendors, to enable inbound and outbound payments through our system.

Security Highlights

From a security standpoint, we are implementing a Services Designer integration with Okta and Active Directory to support widely adopted choices for MFA, such as Google Authenticator, to ensure we have a solution that meets all our customer needs. See more about security below in a note from our CSIO.

We're excited about the innovations and advancements you're making on the OSE platform, and thank your ongoing input and insights that help to shape the future of our product roadmap!

Exciting new updates from OneShield Market Solutions

We recently announced the promotion of Rex Blazevich as President of OneShield Market Solutions (OMS). This appointment reflects the growth and investment in our SaaS solution. Throughout 2022, we prioritized building dedicated implementation, product innovation, and support teams for OMS.

2022 was also a year of expansion and innovation in OMS. As we ramped up our team capacity, we supported a few new lines of business on OMS. Notably, with the addition of MIEC (Medical Insurance Exchange of California), we added our first Medical Professional Liability client. Old Republic Specialty Insurance Underwriters launched a startup division of inland marine on OMS, starting with Builders Risk. In 2023, new OMS client initiatives include the niche segments of financial and cyber liability, legal professional liability, and coverage for municipalities.

In 2022, we addressed customer requests for specialized GL configuration, enhanced reporting, and payment solutions and expanded MFS support to OMS, as security remains an ongoing priority. Listening to your needs for roadmap items, we look forward to meeting your requests for enhanced reporting, self-service configuration, greater extensibility, and additional portal features in 2023.

Today, the OMS team supports a new era of startups, MGAs, and specialty insurers with unique needs, innovative delivery methods, and niche market solutions.

Message from our CISO

2022 was a busy year for security teams across the industry, with ransomware attacks up significantly. It has been interesting to see the changes in the Cyber insurance product and qualifications from previous years showing insurers are also updating their underwriting rules and pre-screening technologies as the cost of cybercrime continue to rise. One area that we have seen a focus on is outdated VPN technologies and the push from the industry to implement Zero Trust solutions to enhance the protection of remote employees, services, and infrastructure.

OneShield continues to enhance our products and services to ensure you feel confident in the solutions we provide. In 2022, we implemented a new EDR platform and improved the security operations center through Rapid 7 services. We have just completed the implementation of Zscaler, the industry leader in Zero Trust. We've also improved our reporting capabilities on the corporate governance, risk, and compliance front by implementing the Secureframe platform. This allows us to keep you up to date on upcoming audits and certifications and improves our process through automation. Finally, our training and testing of all employees keep our security awareness well above industry standards (based on KnowB4 statistics), ensuring our workforce is always current on the latest risks and trends.

Stay vigilant!

Chad Galgay

Top Content for 2022

Continuous Innovation: The Journey of PURE Insurance from Startup to Insurance Market Leader

In December, OneShield Software SVP Leah English and PURE Insurance SVP & CIO Jason Lichtenthal joined Aite-Novarica Group’s Strategic Advisor Stuart Rose, for a fireside chat to discuss PURE’s technology journey, lessons learned, best practices, and more.

Our 2022 State of Technology survey with PropertyCasualty360 revealed insurer priorities, challenges, and tech strategies to remain innovative and meet market demands. Check out the highlights of the survey in our most-read report of 2022.

Cybersecurity & Innovation

For October's Cybersecurity Awareness Month, our CISO, Chad Galgay, participated in our new podcast series, and we've incorporated portions of his talk into this eBook on secure innovation. Enjoy the read, or listen to the podcast here.

Top Tech Trends from Insurance Leaders

This fall, members of our leadership team participated in a 6-episode podcast series with PC360 entitled Top Tech Trends from Insurance Leaders. Topics include cybersecurity, innovation, data analytics, and tech trends.